Fueling the Climate Crisis :

SOUTH KOREA'S PUBLIC FINANCING FOR OIL AND GAS

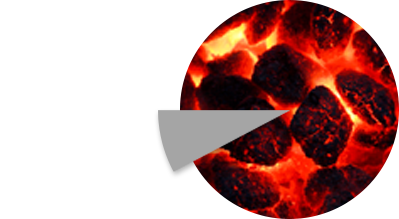

94.7% of the world’s CO2 emissions comes from burning fossil fuels.

Emissions from oil and natural gas account for 54.4% of global CO2 emissions.

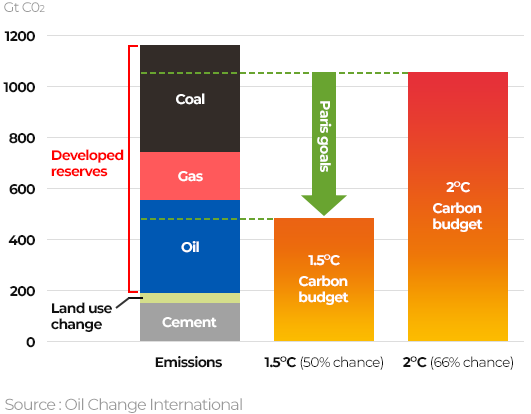

The estimated emissions from developed fossil fuel reserves already

exceed the global carbon budget available to meet Paris Agreement

temperature goals, leading to temperature rise beyond 2˚C.

We cannot afford more fossil fuels.

However, public finance is still driving new fossil fuel development around the world.

South Korea was identified as the 4th largest public financier of

fossil fuels among G20 countries.

In April 2021, South Korea announced its official moratorium on overseas

coal financing. However, coal is just a small part of the problem.

Solutions for Our Climate investigated

Korean public financial institutions’ support to oil and gas

infrastructure in the past 10 years.

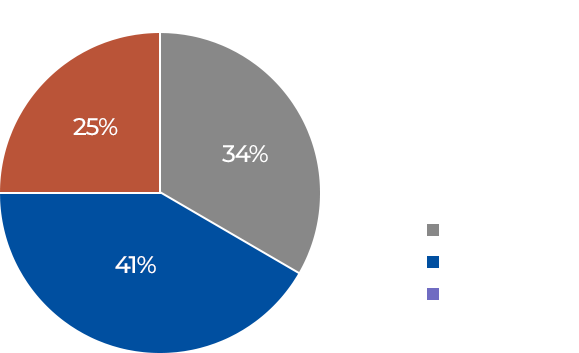

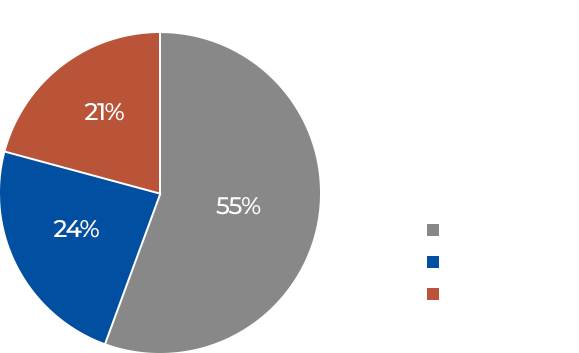

The Export-Import Bank of Korea (KEXIM), Korea Trade

Insurance Corporation (K-SURE), and Korea Development Bank

(KDB) have provided $127.15 billion to oversea oil and gas

projects in the past ten years.

Korea’s public finance to oil and gas is in fact 13 times larger

than the amount of coal financing in the same period.

Korea's public financing for oil and gas infrastructure

covers the entire value chain.

Upstream refers to the exploration,

extraction, production and processing of

oil and gas.

Midstream is related to the transportation

of oil and gas, including pipelines,

transportation vessels, storage, terminals,

and liquefaction and regasification plants.

Downstream includes

refining crude oil into

various products, as well as

end-use facilities such as

thermal power and

petrochemical plants

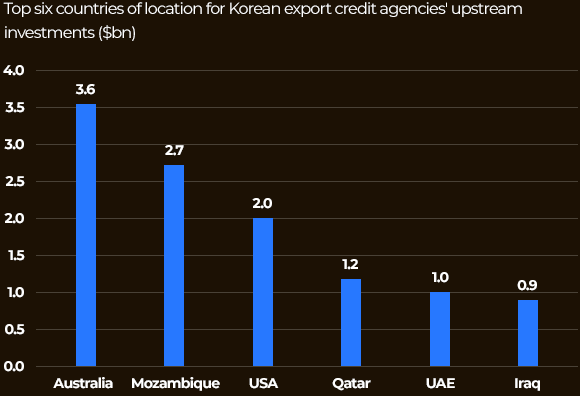

The major Korean players in the upstream sector are the

state-owned Korea Gas Corporation (KOGAS) and

Korea National Oil Corporation (KNOC), as well as private

corporations such as SK E&S, GS Energy, and POSCO

International.

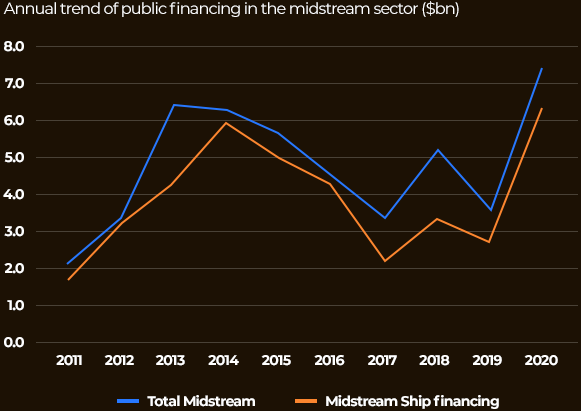

Korean shipbuilders and construction companies are

very active in the midstream sector, building pipelines

and terminals, as well as transportation vessels for crude

oil and liquefied gas.

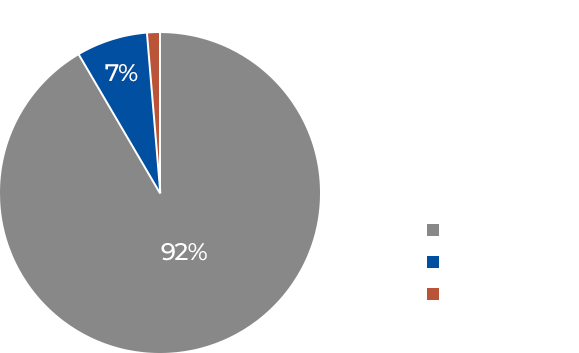

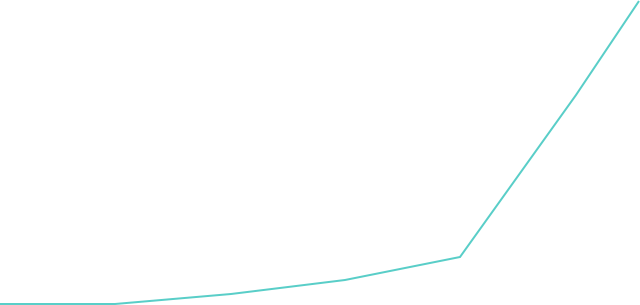

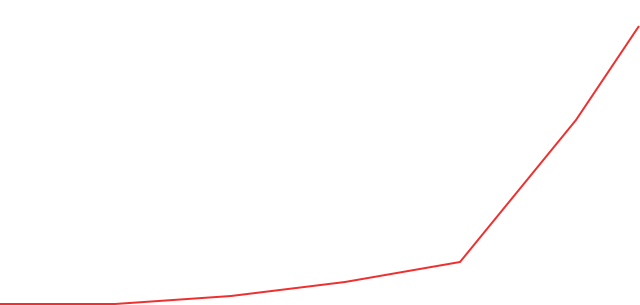

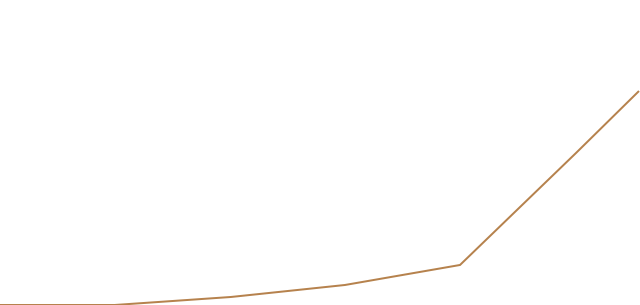

The majority of public financing in the midstream

sector is going into ship financing, particularly in the

form of guarantees, with a noticeable increase

in recent years.

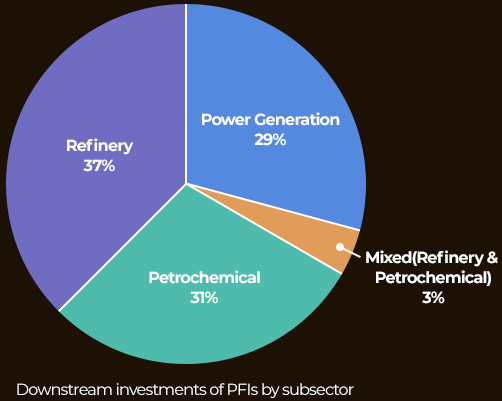

Public financing in the downstream sector is provided

to Korean construction companies including GS E&C,

Daewoo E&C, SK Ecoplant, Hyundai E&C,

and Samsung C&T. These companies have taken

Engineering, Procurement, and Construction (EPC)

projects for oil refineries, petrochemical plants, and

thermal power plants.

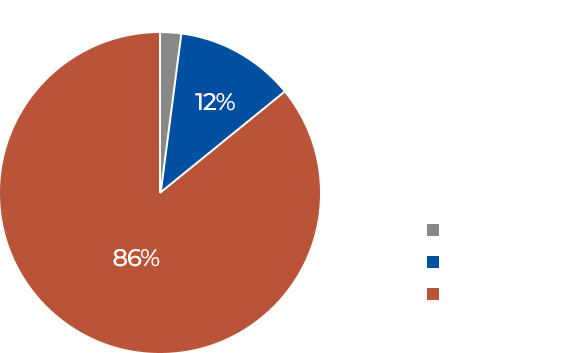

Financing

Korea has the largest shipbuilding

industry in the world, dominating

44.2% of the global market in 2018,

followed by China (32.0%) and

Japan (12.6%).

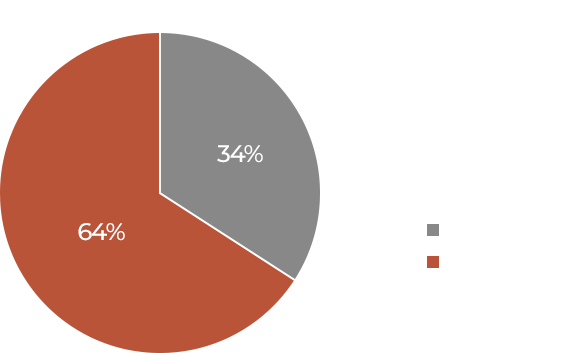

Shipbuilders received 46% of all

Korean public finance to oil and gas

in the past ten years, which amounts to

$57.7 billion.

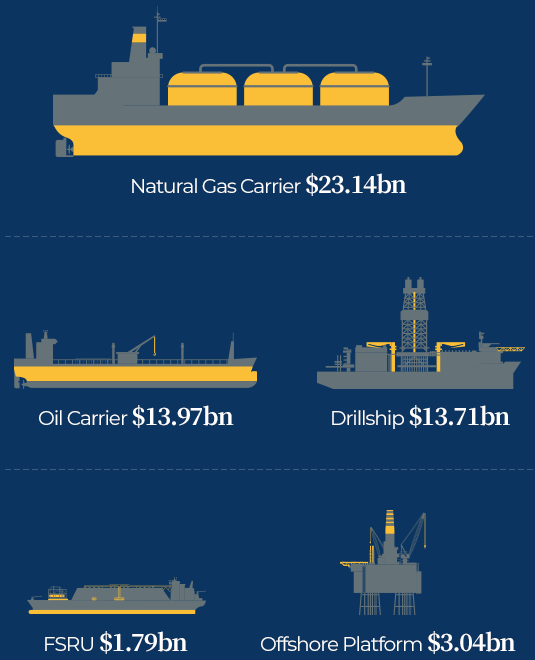

Drillships, offshore plants, and

transportation vessels are critical

components of the oil and gas value

chain and also major products for

Korean shipbuilders.

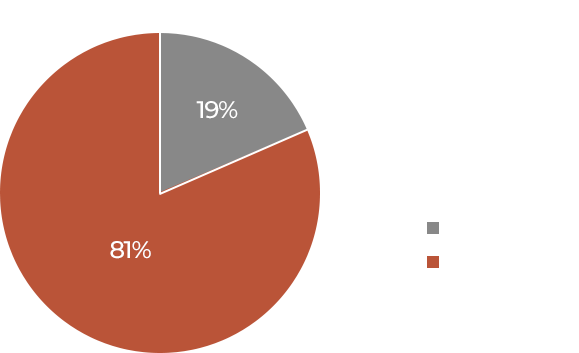

In 2020, the top three Korean

shipbuilders won 73% of the

LNG carrier vessel orders and 81% of

Very Large Crude Oil Carrier (VLCC)

orders in the global market.

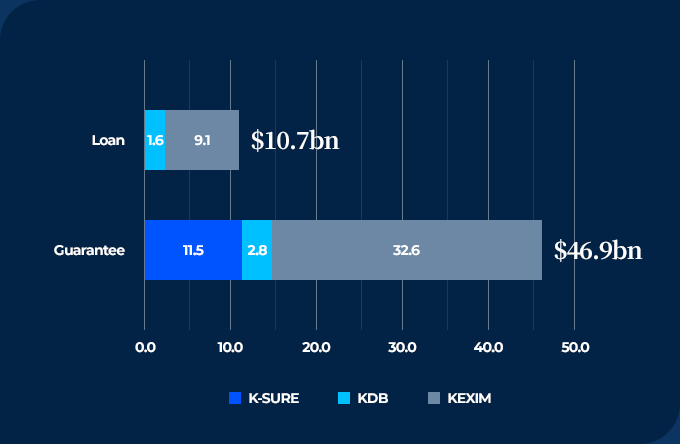

Public financial institutions provide

loans and guarantees to

the shipbuilding industry.

Refund Guarantees (RG), in particular,

are a critical element of ship financing.

Public financial institutions such as

KEXIM and K-SURE are major issuers of

RGs for Korean shipbuilders.

Ships and offshore plants play a key role in the

production of oil and gas. Drillships are used

for the exploration and drilling of new oil and

gas wells in the ocean.

Offshore platforms are used for extraction,

processing, and storage.

Transportation vessels include crude oil carriers,

gas carriers, and regasification units for LNG.

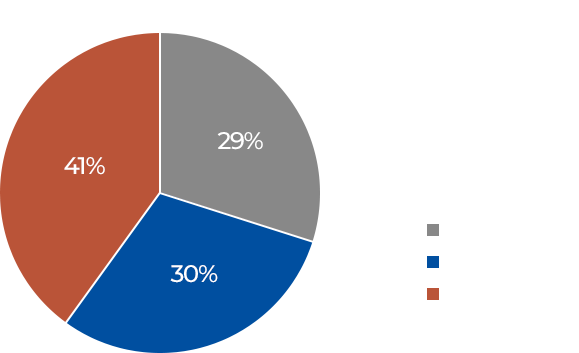

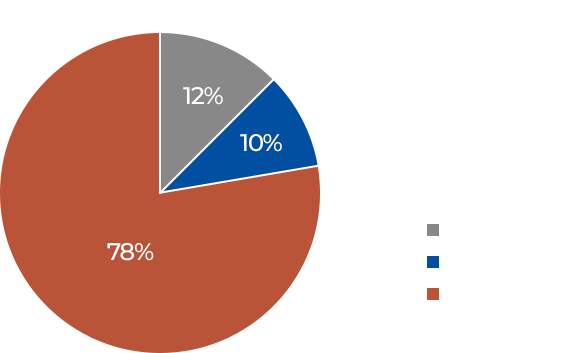

Out of $57.7 billion, 71% was provided to

transportation vessels. LNG carriers received

the most public funds, $23.14 billion,

as Korean shipbuilders are dominant

in the LNG carrier market.

Why is this a problem

Financial Risk

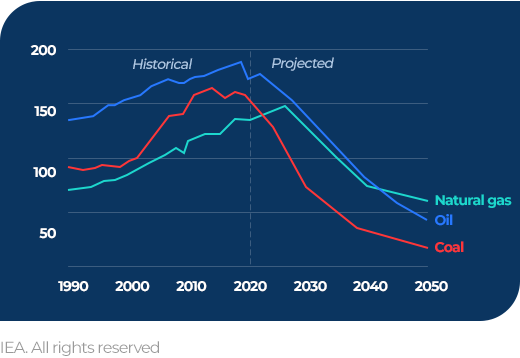

Oil and gas projects are exposed to significant “stranded asset

risk.” Oil and gas infrastructure requires massive funding fort

construction and needs to operate for decades to recover initialt

investments. However, the phase-out pathway for fossil fuels ist

likely to render the asset useless before its end of life.

In Net Zero by 2050: A Roadmap for the Global Energy Sector,

the IEA has suggested there is no need for investment in new

fossil fuel supply for net-zero pathway.

Continued financing for oil and gas will compromise the

financial stability of public financial institutions.

Environmental Risk

Investment in fossil fuels increases carbon emissions.

Additional investment is unnecessary because existing global

fossil fuel reserves already exceed the carbon budget for Paris

climate goals.

Public financing to fossil fuels cannot be justified because

exacerbating the climate crisis contradicts the public interest.

Transition Risk

Public finance is de facto a form of government subsidy or

support.

Providing public support for fossil fuels increases the transition

risk to the economy, locking in more jobs, capital, and

infrastructure into industries that need immediate transition.

Public finance to oil and gas is a threat to the economy.

Legal Risk

Financing fossil fuel-related projects with public funds

contradicts the state’s obligations under international law as it

significantly contributes to increasing carbon emissions.

Public financial institutions are beginning to restrict their

investment in fossil fuels, including oil and gas.

The UK Government announced its plans to stop public

financing for fossil fuels in December 2020.

The European Investment Bank plans to do the same by the

end of 2021. Swedish export credit agencies EKN and SEK

have announced their plans to stop financing the exploration

and extraction of fossil fuels by 2022.

We suggest the following to the Korean public financial institutions:

- 1Stop providing public finance to new oil and gas projects and halt increasing the

financing to existing ones - 2Establish concrete plans to decrease existing support for oil and gas projects in line

with the Paris Agreement temperature goals - 3Establish procedures and standards to screen potential projects based on their

climate impact - 4Implement transparent standards to assess and disclose climate-related financial

risks of the financial institution